Professional Services

Making Growth Work: Professional Services

We understand the challenges you face and apply our firsthand experiences to help take your business to the next level. From law firms to advertising firms, business consulting firms, and physician practices, we serve an array of professional services clients. We offer timely advice scaled specifically to your firm. You’ll be kept up to date on the latest in tax strategies, and as you look to grow and expand, we help with tax structuring so you’re not leaving money on the table. We go beyond simple compliance, providing the insights you need to balance risk, value, and cost.

Planning

Preparation

Services

Statements

Consulting

TAX PLANNING

EXCEPTIONAL THINKING AND PROBLEM SOLVING FOR THE PROFESSIONAL SERVICES INDUSTRY

We take an integrated approach to help you find your best tax position, bringing your business aims and personal goals into a unified tax strategy.

We quickly grasp the distinct situation, needs, and goals of your business, and we develop a comprehensive tax plan to reduce your tax burden and maximize your cash flow.

We can provide all related services as needed, or work with your organization’s own professionals – either way, you’ll get detailed planning and analysis.

We can also review your existing tax methods and correct them (if needed) to operate as favorably for you as possible.

TAX PREPARATION

EXPERT GUIDANCE FOR THE PROFESSIONAL SERVICES INDUSTRY

Be confident navigating the constantly changing and increasingly complex tax environment of the professional services industry with us at your side.

Let our DPW Tax Prep Team guide you successfully through the ever-changing landscape of regulations and requirements. We’ll help you improve your federal, state, and local tax liability picture with proven expertise.

We carry in-depth industry knowledge, seasoned tax experts, and a thorough understanding of your business to minimize liabilities across the board.

And because we know business people are people too, we integrate business tax preparation with income tax preparation too.

PAYROLL

REDUCE TIME SPENT AND INCREASE ACCURACY

We help you reduce the time spent on payroll administration by developing and implementing payroll systems to speed processing, make timely and accurate payment and preparation of tax payments.

With DPW, this basic but essential component of your business can be handled without missing a beat or slowing you down. Taking one more thing off your plate. Doing the business basics exceptionally is part of our culture at DPW.

FINANCIAL STATEMENTS

SOLUTIONS SCALED TO THE PROFESSIONAL SERVICES INDUSTRY

Your financial statement will be planned and executed by an experienced team that understands the professional services industry, your business goals, and the needs of the financial statement users.

We scale our solutions to meet your specific needs without needless delay because the needs of your financial statement users will vary.

Beyond the immediate needs of our financial summaries, you’ll gain important insights into your operations which results in increased efficiency of your efforts.

Advisory

STRATEGIC THINKING FOR THE PROFESSIONAL SERVICES INDUSTRY

Our advisory services are based on a thorough understanding of your business and personal goals. Our recommendations form actionable and realistic paths for opportunities and improvement.

We perform studies and analyses to maximize your ability to capitalize on opportunities and improve profitability. We ensure your current accounting method serves your goals as well as it should.

We help you identify opportunities for growth that safeguard your assets from tax liabilities even as they offer increased earnings.

Planning

Preparation

Services

Statements

Consulting

TAX PLANNING

EXCEPTIONAL THINKING AND PROBLEM SOLVING FOR THE PROFESSIONAL SERVICES INDUSTRY

We take an integrated approach to help you find your best tax position, bringing your business aims and personal goals into a unified tax strategy.

We quickly grasp the distinct situation, needs, and goals of your business, and we develop a comprehensive tax plan to reduce your tax burden and maximize your cash flow.

We can provide all related services as needed, or work with your organization’s own professionals – either way, you’ll get detailed planning and analysis.

We can also review your existing tax methods and correct them (if needed) to operate as favorably for you as possible.

TAX PREPARATION

EXPERT GUIDANCE FOR THE PROFESSIONAL SERVICES INDUSTRY

Be confident navigating the constantly changing and increasingly complex tax environment of the professional services industry with us at your side.

Let our DPW Tax Prep Team guide you successfully through the ever-changing landscape of regulations and requirements. We’ll help you improve your federal, state, and local tax liability picture with proven expertise.

We carry in-depth industry knowledge, seasoned tax experts, and a thorough understanding of your business to minimize liabilities across the board.

And because we know business people are people too, we integrate business tax preparation with income tax preparation too.

PAYROLL

REDUCE TIME SPENT AND INCREASE ACCURACY

We help you reduce the time spent on payroll administration by developing and implementing payroll systems to speed processing, make timely and accurate payment and preparation of tax payments.

With DPW, this basic but essential component of your business can be handled without missing a beat or slowing you down. Taking one more thing off your plate. Doing the business basics exceptionally is part of our culture at DPW.

FINANCIAL STATEMENTS

SOLUTIONS SCALED TO THE PROFESSIONAL SERVICES INDUSTRY

Your financial statement will be planned and executed by an experienced team that understands the professional services industry, your business goals, and the needs of the financial statement users.

We scale our solutions to meet your specific needs without needless delay because the needs of your financial statement users will vary.

Beyond the immediate needs of our financial summaries, you’ll gain important insights into your operations which results in increased efficiency of your efforts.

Advisory

STRATEGIC THINKING FOR THE PROFESSIONAL SERVICES INDUSTRY

Our advisory services are based on a thorough understanding of your business and personal goals. Our recommendations form actionable and realistic paths for opportunities and improvement.

We perform studies and analyses to maximize your ability to capitalize on opportunities and improve profitability. We ensure your current accounting method serves your goals as well as it should.

We help you identify opportunities for growth that safeguard your assets from tax liabilities even as they offer increased earnings.

Professional SERVICES - Services

TAX PLANNING

EXCEPTIONAL THINKING AND PROBLEM SOLVING FOR THE PROFESSIONAL SERVICES INDUSTRY

We take an integrated approach to help you find your best tax position, bringing your business aims and personal goals into a unified tax strategy.

We quickly grasp the distinct situation, needs, and goals of your business, and we develop a comprehensive tax plan to reduce your tax burden and maximize your cash flow.

We can provide all related services as needed, or work with your organization’s own professionals – either way, you’ll get detailed planning and analysis.

We can also review your existing tax methods and correct them (if needed) to operate as favorably for you as possible.

TAX PREPARATION

EXPERT GUIDANCE FOR THE PROFESSIONAL SERVICES INDUSTRY

Be confident navigating the constantly changing and increasingly complex tax environment of the professional services industry with us at your side.

Let our DPW Tax Prep Team guide you successfully through the ever-changing landscape of regulations and requirements. We’ll help you improve your federal, state, and local tax liability picture with proven expertise.

We carry in-depth industry knowledge, seasoned tax experts, and a thorough understanding of your business to minimize liabilities across the board.

And because we know business people are people too, we integrate business tax preparation with income tax preparation too.

PAYROLL

REDUCE TIME SPENT AND INCREASE ACCURACY

We help you reduce the time spent on payroll administration by developing and implementing payroll systems to speed processing, make timely and accurate payment and preparation of tax payments.

With DPW, this basic but essential component of your business can be handled without missing a beat or slowing you down. Taking one more thing off your plate. Doing the business basics exceptionally is part of our culture at DPW.

FINANCIAL STATEMENTS

SOLUTIONS SCALED TO THE PROFESSIONAL SERVICES INDUSTRY

Your financial statement will be planned and executed by an experienced team that understands the professional services industry, your business goals, and the needs of the financial statement users.

We scale our solutions to meet your specific needs without needless delay because the needs of your financial statement users will vary.

Beyond the immediate needs of our financial summaries, you’ll gain important insights into your operations which results in increased efficiency of your efforts.

Advisory

STRATEGIC THINKING FOR THE PROFESSIONAL SERVICES INDUSTRY

Our advisory services are based on a thorough understanding of your business and personal goals. Our recommendations form actionable and realistic paths for opportunities and improvement.

We perform studies and analyses to maximize your ability to capitalize on opportunities and improve profitability. We ensure your current accounting method serves your goals as well as it should.

We help you identify opportunities for growth that safeguard your assets from tax liabilities even as they offer increased earnings.

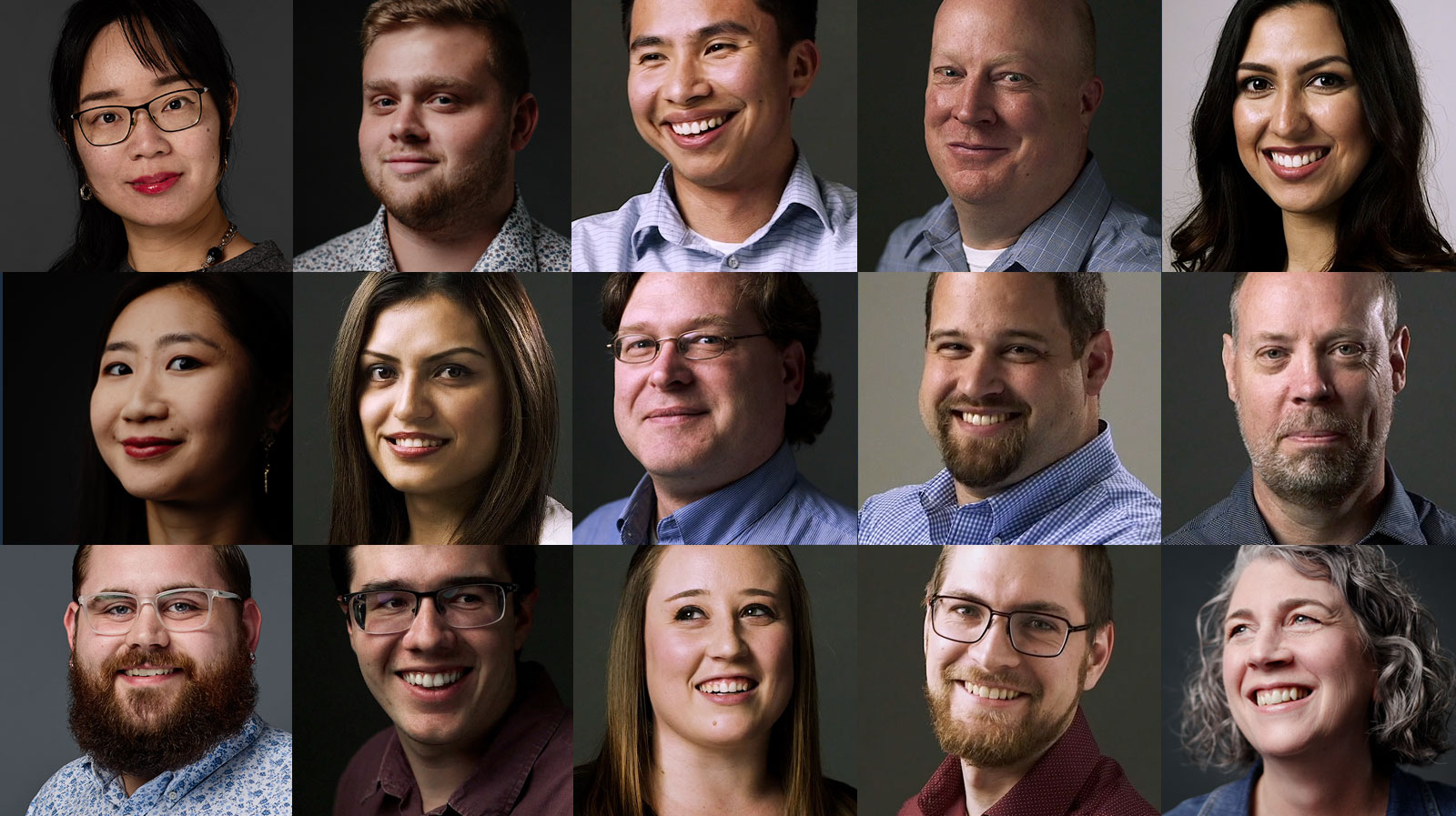

Professional Services - Service Team

Our Professional Services team is staffed by professionals well experienced in this challenging industry. Team members stay abreast of the many changes in federal and state tax and regulation occurring yearly and are always backed up by partner-level supervision and oversight.

All of our services are offered in English, Spanish, and Japanese.

Send a note to the team

Professional Services Articles and Current Alerts

3 Business Valuation Methods-How to Determine What a Company Is Worth

A business valuation is a way to determine the economic value of a company, which could be useful in several situations. For example: You may

Financial Statement Preparation and Analysis from Your CPA

When they think about working with an accountant, most small business owners think about taxes. But accountants provide a host of more comprehensive and helpful

Oregon’s Incentives

Oregon offers globally competitive incentives to encourage business expansion. Property Tax Abatement Enterprise Zones—In exchange for investing and hiring in an enterprise zone, businesses receive

Here’s Why Accountants Are Important in Dealing with Estate Matters

When executing an estate plan it is important to have a team of talented professionals that can help advise you. An estate planning attorney is