Make the Most

of Your Earnings

As you begin the earning phase of your career, make the most of those earnings now and for years to come. With careful planning, you’ll create a financial safety net and help to secure your future financial stability. To achieve that, you need the guidance of smart strategic planning and impartial advisory services.

Congratulations! You’re Now a Business Owner

DPW knows the kinds of planning and strategies you’ll need to consider.

Check These Six Points for Success:

Help Define Your

Business Structure

Which of several structures will your business take? Since each structure handles taxes differently, the short and long term ramifications will be critical to understand.

Help Protect

What You Earn

DPW works hard to protect every bit of what you’ve earned through careful application of those tax laws which benefit you.

Help Setup Accurate

Record Keeping

NIL income can be complex to report, especially if the athlete is earning income from multiple sources. We’ll help you keep track of income and expenses, and show you how to keep accurate records of all income and expenses related to NIL activities.

Help Track Multiple

State Tax Liabilities

In addition to regular income taxes, your NIL payments may be subject to self-employment tax as well as state taxes in multiple states and local jurisdictions. DPW will help you navigate this complex area of the law.

Guidance in the

Growth of Your NIL Business

As a Business Strategy and Advisory firm, DPW can offer help outlining directions for growth of your NIL business as your brand value increases. We help identify areas of growth, assess the financial risks of expansion, and recommend strategies to optimize cash flow.

Help Filing Taxes

Accurately and On Time

It's important to file taxes accurately and on time to avoid any penalties or interest charges and ensure that you’re in compliance with ever-changing tax laws. We’ll help keep all that straight.

Ready to schedule a meeting?

FAQs

Easy – contact us by email, text, or a phone call and we’ll set up a time to discuss your particular goals and needs.

As soon as you know you’ll be receiving compensation for NIL activities, you should begin to plan for how to structure this new source of income. Reach out to DPW and we’ll review your individual situation.

You are allowed to take ordinary and necessary expenses for your business. An ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary. And of course, keep receipts for all your expenses.

Specific questions about expenses should be answered in personal consultation with DPW. Reach out and we’ll review your individual situation.

Get the DPW NIL Fact Sheet below. It covers a lot of topics you’ll need to know for your NIL business.

Specific questions about deductions should be answered in personal consultation, but some common questions we’ve gotten are:

- Sneakers and jewelry are considered personal effects and are not deductible

- Cell phones may be partially deductible.

- Travel meals – 50% deductible

Of course, deductibility is a complicated topic! Reach out and we’ll review your individual situation.

Get the DPW NIL Fact Sheet below. It covers a lot of topics you’ll need to know for your NIL business.

You will need to file either a tax return or extension by April 17th of 2024 for income earned in 2023.

Get the DPW NIL Fact Sheet below. It has tips and answers to questions like business types, quarterly tax payments, 1099 forms, self-employment tax – and a lot more.

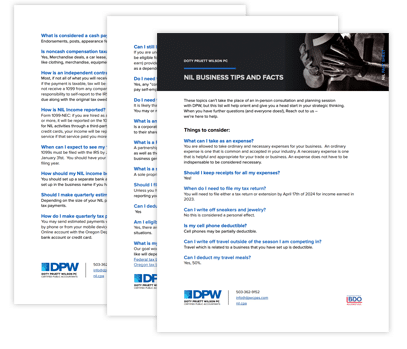

The fact sheet is a quick look at some of the common topics we’ve been hearing from NIL athletes.

Free NIL FACT SHEET

Top 25 questions answered. Get a head start on your strategic thinking!

Why DPW

Your Collective has chosen DPW as the preferred Business Strategy and Advisory CPA firm to help you in making the most of your income potential.

Your Collective has chosen DPW as the preferred Business Strategy and Advisory CPA firm to help you in making the most of your income potential.

With over 38 years as a full-service CPA firm, DPW is well qualified to guide you in your new role in owning a NIL business.

Since our beginnings, we’ve grown to accommodate the ever-changing needs of our clients – and now bring our expertise to bear on the unique needs of the NIL athlete, bringing the best in professional consultation to these special clients.

In addition to advisory and strategic planning, we offer an entire array of CPA services to help you succeed. Our team of more than 40 qualified professionals is ready to greet you with a smile and provide top-quality services for all your business and accounting needs.

With over 38 years as a full-service CPA firm, DPW is well qualified to guide you in your new role in owning a NIL business.

Since our beginnings, we’ve grown to accommodate the ever-changing needs of our clients – and now bring our expertise to bear on the unique needs of the NIL athlete, bringing the best in professional consultation to these special clients.

Be Welcomed

We make it simple to bring your questions and needs to DPW. You’ll be welcomed into an environment where your personal concerns are as important to us as they are to you.

Call 503-362-9152 or email us to schedule a time to talk.